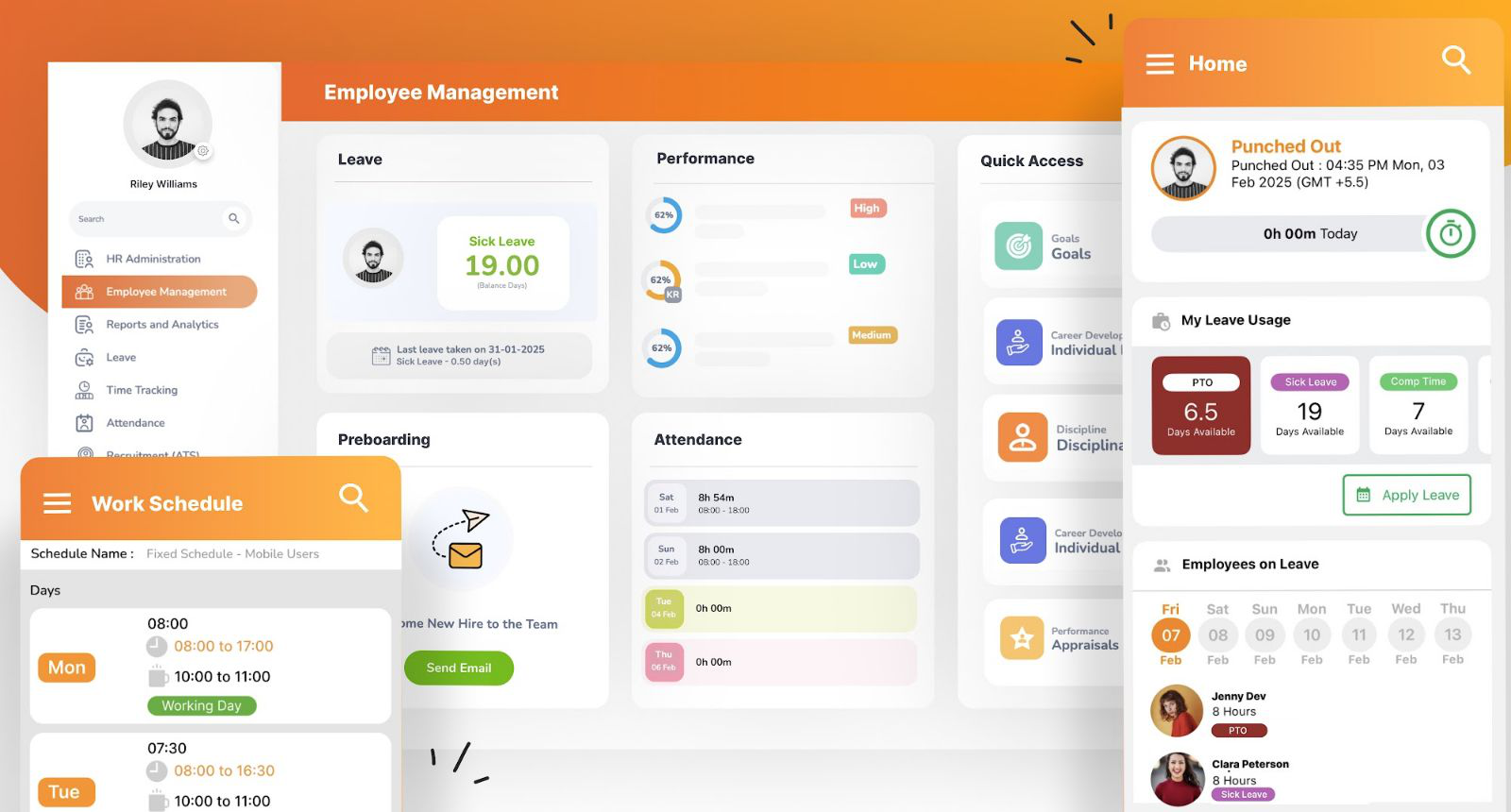

People Management

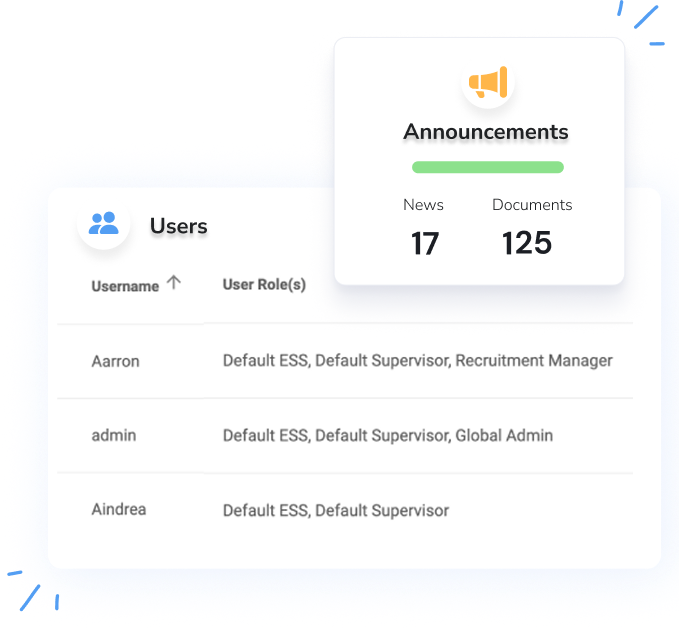

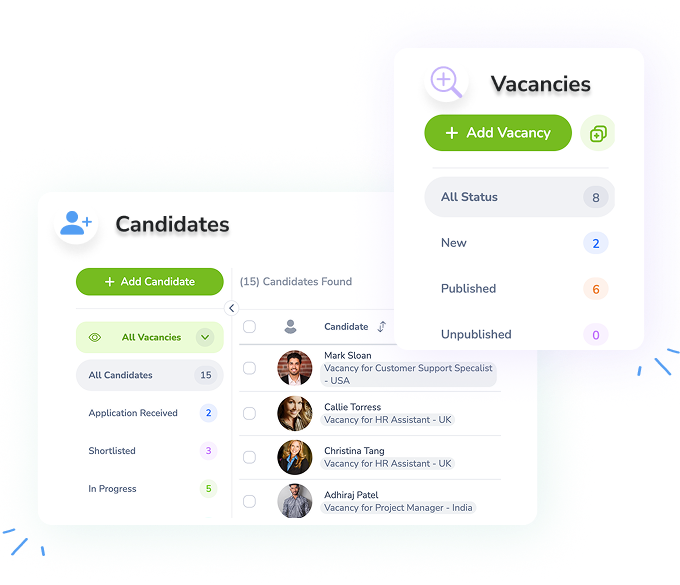

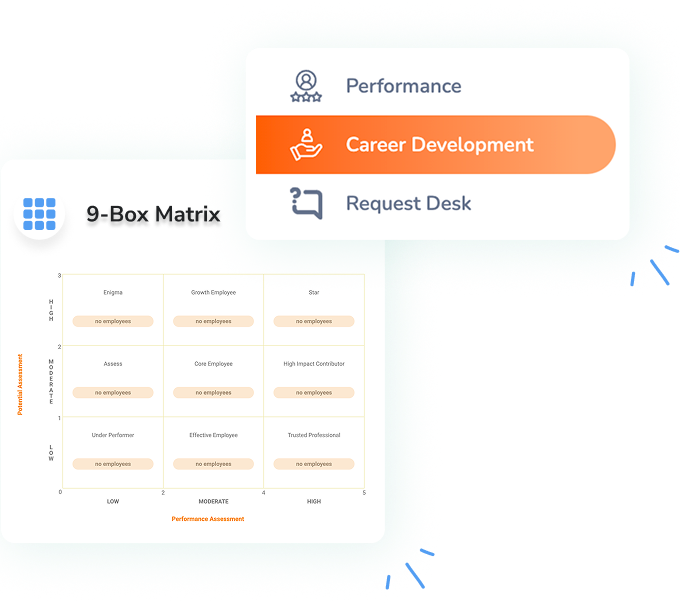

The demands of HR, from managing daily challenges to overseeing extensive paperwork, can be significant. With a strong people management strategy backed by automating your HR processes, you can equip your team with the necessary resources to thrive.